Evolution of russian ERP-systems market

- Подробности

- Опубликовано: 16.07.2018 16:56

- Автор: Степанов Д.Ю., Бикашов И.Д.

- Просмотров: 16177

Аннотация: there are trends of ERP-systems evolution, key players at Russian market, analysis of Russian ERP-systems and evolution trends of Russian ERP-systems market considered in the paper. Key ERP-system from SAP, Oracle, Microsoft, Sage as well as 1C, Galaktika and Parus were discussed inside. Strengthening and growing 1C software products was concluded as evolution trend of Russian ERP-systems market.

Скачать: PDF (версия 1), PDF (версия 2).

Ключевые слова: 1С, 1С предприятие, система 1С, 1C ERP, 1С УПП, 1С ERP управление предприятием, развитие 1С, развитие 1С предприятия, галактика ERP, парус ERP, SAP ERP, система управления ERP, эволюция ERP-систем, эволюция информационных систем управления предприятием, эволюция корпоративных информационных систем управления, рынок ERP систем, рынок erp систем в россии, рынок ERP, современные ERP системы, современные ERP-системы их назначение и возможности, примеры ERP систем, erp системы обзор, сравнение ERP систем, ERP системы описание, ERP-системы в россии, российские КИС, отечественные КИС, рынок корпоративных информационных систем, российские корпоративные информационные системы, характеристика российского рынка корпоративных информационных систем, российская корпоративная информационная система.

Are you sure growing enterprise does not need ERP-system? Let’s imagine there are a few implemented applications within company to provide business continuity. Each application has different architecture and not integrated with others. In this case generating cross company analytical reports is almost manual activity. Only fully implemented ERP-system allows gathering information from various applications into single source [1]. To provide advantages of ERP-systems to business as usual need to know trends of their evolution.

Objective

The objective of the paper is considering evolution of Russian ERP-systems and market to obtain more profit to business using such kind of systems. To realize this aim, trends of ERP-systems evolution, key players at Russian market, analysis of Russian ERP-systems and evolution trends of Russian ERP-systems market will be discussed.

1. Trends of ERP-systems evolution

A lot of ways allow predicting trends of ERP-system evolution, like psychological activation or organic groups of problem solve methods. Some trends can be found in article [2], thus development of a new core applications from commonly used program components; adaptation of solutions to new technologies (mobile platforms, clouds etc.); paying attention to a big data handling can be highlighted.

Starting from business level, trends of ERP-system evolution will include covering more and more business processes by the system. That means, when all typical processes realized in ERP-system, then all other business processes need to be developed and integrated into single landscape. As an example, consider development of ERP than SRM, CRM, PLM, SCM-systems, moreover operational MES and analytical BW-systems.

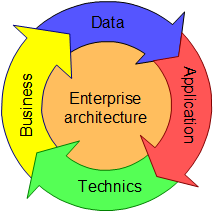

Let’s summarize mentioned above trends based on understanding enterprise architecture [3]. It is not secret enterprise architecture can be considered as a set of levels: business, data, application and technics (fig.1). To be in line with it, need to discuss each architectural level separately.

Fig. 1. Enterprise architecture components

Dealing with data level, need to underline ERP-system has to handle huge unstructured set of information. Thus concept of data storing, managing and mining must be enriched by a new software and hardware solutions. For instance, to deal with big data database must include software programs as well as hardware components like in SAP HANA solution.

Application and technics levels say proposed program solution must be cross platform, which provide access to the system via laptop, desktop, mobile, tablet computers or other electronic devices. ERP-system grows day to day, so one of trend will be simplification of ERP-system implementation process. Reviewing ERP-system evolution trends allows us having a deep dive in Russian market of ERP solutions.

2. Key players at Russian market of ERP-systems

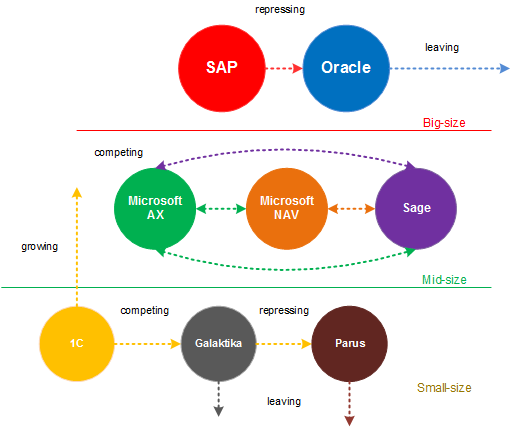

Originally Russian market of ERP-systems represented by SAP, Oracle, Microsoft, Sage, 1C, Galaktika and Parus companies and their solutions SAP Business Suite, Oracle e-Business Suite, Microsoft Dynamics Axapta and Navision, Sage ERP, 1C ERP, Galaktika ERP and Parus correspondingly. SAP and Oracle solutions mostly oriented to large business, the rest to medium and small clients [4]. Unfortunately, Oracle ERP products have been being implemented to enterprises less and less. Initially Oracle solutions utilized in telecommunication and energy industries. Nowadays SAP oppresses Oracle on all Russian fronts. In fact, market share of Oracle solutions much decreased toward SAP ERP products. This is a trend for a last few years.

Microsoft Dynamics as well as Sage ERP-systems are oriented to mid-size business covering product life-cycle management from procurement to sales. Functionality of these systems quite similar and differs only in technical realization [5]. Russian ERP-systems are adapted to low-size clients. 1C ERP-system is originally accounting system enriched by ERP functions. ERP-core of the system was shape by subject matter experts in procurement, logistics, production and sales. Galaktika ERP is a pure Russian ERP-system. Parus ERP aligned more with government then private company’s business processes. Let's continue with Russian market of ERP-systems evolution trends.

3. Russian market of ERP-systems evolution trends

Certainly behavior of ERP market strongly depends on economic situation in the country. There are no cardinal changes in Russian big ERP market. SAP more and more pushes Oracle solutions from all Russian industries. So that, number of SAP implementations quite stable unlike Oracle. More often international and local holdings use SAP products. A lot of big enterprises already implemented SAP ERP solution. Thus the only way for them to dominate at market is providing improvements, extensions and enrichments for implemented solutions. This is not difficult task due to SAP follows almost all ERP-system evolution trends.

Situation in middle market is little bit different. ERP-system by definition provides integration between all business activities within enterprise. But Russia has specific accounting principles. Thus almost all foreign ERP-systems not aligned with Russian accounting standards. As a result, ERP-systems must cover such gaps by developing missed functionality during implementation phase. There are powerful local software solutions for accounting purposes in Russia, so that foreign ERP-systems used mostly for logistics business processes integration.

Taking into account this point, mid-size ERP solutions represented by Microsoft and Sage have similar program features oriented to logistics processes automatization. Dynamics Axapta, Navision and Sage ERP competition predictable, however there will be no winners and losers. One more thing, each middle size company lives between two extremities: grow to large corporation or become small firm. If first outcome happens, then ERP-system need to be updated based on increased business requirements, which mean 100% implementation big-size ERP-system like SAP Business Suite or Oracle e-Business Suite. On the other hand, there is no need in expensive ERP solutions for small companies, thus 1C ERP, Galaktika ERP or Parus to be used.

Regarding small-size ERP-systems, certain lead is 1C providing automation a great number of business processes. Logistics, finance, human resources and other business processes; agriculture, oil, metallurgy and other industries including public sector, it is an examples of 1C functional capabilities. Other Russian solutions Galaktika ERP and Parus seems loosing in comparison with 1C ERP. So, the trend for small-size ERP market is 1С ERP-system reinforcement. To consider evolution trends of Russian ERP-systems market need to analyze weak and strong points of such systems.

4. Analysis of Russian ERP-systems

1C ERP is a first ERP-system developed by 1C company. Before it 1C were all about accounting and separate logistics applications where key system elements were printing documents but not business objects. There were a lot of standalone and industrial solutions not integrated together. Now 1C considered as a development platform, which allows uniting different applications into single landscape as it was done for 1C ERP-system. To become key player 1C need to generalize ERP solution and overcome one country legislation restrictions.

Table 1. Russian ERP-systems advantages and disadvantages

|

Vendor |

Advantage |

Disadvantage |

| 1C | Variety of automated business processes | Many solutions not integrated together |

| Big quantity of available industrial solutions | Too localized to country legislation | |

| Russian specifics implemented | Applications roadmap not available | |

| Galaktika | System oriented to production companies | Many modules not integrated together |

| Russian specifics implemented | No support of holding companies | |

| Client customization available | Poor standard analytics | |

| Parus | Orientation to budget-financed organizations | Production processes not realized |

| Customer adaptation available | Poor standard analytical reports | |

| Low technical requirements | Low performance |

Galaktika ERP orients to production enterprises and at a time contains strong accounting and tax functionality for Russian legislation. The ERP-system can be customized to client needs. However, like 1C applications there is no pure integration between different components of ERP-system. Thus it cannot be used for large companies. Unlike Galaktika Parus ERP-system deals with budget-financed organizations exclusively. System does not have high technical requirements as a result has low performance. Both Galaktika and Parus ERP-systems have weak point in standard analytical reports (tab.1).

5. Evolution of Russian ERP-systems market

What is 1C for us? First of all, that is platform which can be used to integrate together various 1C and third party business applications. Than it is a company having wide expertize in different business arias like accounting, tax, sales, procurement, transportation etc. Moreover, it’s not expensive program developing over CIS. All that explains why 1C products penetrate into Russian companies more and more. Certainly, 1C ERP-system is an experiment and investment in the future. First time Russian ERP-system was developed looking over a great number of implemented business applications, in cooperation with business experts from distinct companies, based on stable software platform. Yes, it was experiment, but successful experiment.

Fig. 2. Evolution trends of ERP-systems Russian market

1C ERP-system follows development approach from concrete to abstract against well-known big and mid-size ERP-systems. To compete with other ERP-systems 1C need to pay more attention to program components integration, roadmapping, implementation methodology. Only vertical and horizontal functional growing 1C ERP-system will allow moving from small to mid-size business. This is evolution trend of Russian ERP-systems market: strengthening, growing 1C software products and decreasing all other Russian ERP-systems. Fig.2 illustrates overall results of evolution trends analysis.

References

- Stepanov D.Yu. ERP-system implementation as a way to improve business processes // Fundamental problems of radioengineering and device construction. – 2015. – vol.15, №1. – p.156-158.

- Stepanov D.Yu. Modern approaches of ERP-systems development based on SAP business solutions // Post graduate. – 2013. – vol.78, №6. – p.168-172 (in Russian).

- TOGAF Version 9.1. A pocket guide / Andrew Josey etc. – UK.: Van Haren Publishing, 2011. – 160 p.

- Bradford M. Modern ERP: select, implement, and use today's advanced business systems. – UK: Lulu.com, 2015. – 284 p.

- Singh S. ERP implementation in SMEs. – USA: LAP Lambert Academic Publishing, 2014. – 256 p.

Paper details

Stepanov D.Yu., Bikashov I.D. Evolution of russian ERP-systems market // Fundamental problems of radioengineering and device construction. – 2016. – vol.16, №1. – p.244-247. – URL: http://stepanovd.com/science/35-article-2016-2-ruserp.